I’m young and barely starting my career, which means that I come in contact with a lot of young people who are in the same position. Mid-twenties and making real money for the first time. It never fails to surprise me how few people my age know what a Roth IRA is, much less take advantage of it. I opened my Roth IRA at the age of 18 and have maxed it out every year since. That’s $28,000 in contributions. And guess what? I’m super rich now. I’ve managed to turn that $28,000 into $26,000. Woot woot. Okay, maybe there were some poor investment choices in the past. Remember in 2008 when the sky was falling? Do you remember some of the risky companies that were hit the hardest? Do Wachovia, WaMu, Circuit City, Citibank, and AIG ring a bell? Ohhh yeaaah. I invested in those guys…which brings me back to why my current portfolio is worth less that my contributions…but back to the real reason for this article.

You’ve probably heard that compounding is magical, but I think an illustration does best at showing this. If you’ve taken a personal finance course at any time then you’ve probably seen a similar illustration. There are two young individuals who are starting out their careers at age 23. We have Saver Steve and Fun Fred. Both of them got a job making decent money. Nothing high, but enough to save some for retirement.

You’ve probably heard that compounding is magical, but I think an illustration does best at showing this. If you’ve taken a personal finance course at any time then you’ve probably seen a similar illustration. There are two young individuals who are starting out their careers at age 23. We have Saver Steve and Fun Fred. Both of them got a job making decent money. Nothing high, but enough to save some for retirement.

Saver Steve embraces balance in his life. He knows that in order to secure his future, he needs to make some sacrifices today. He drives a used car, but he still gets his Starbucks Mocha each morning and eats out with friends on the weekend. He has his employer deposit $208 from each paycheck to a separate savings account, and then he deposits this money into a Roth IRA. He does this from age 23 to age 37 and then completely stops making additional deposits. Don’t ask me why.

Fun Fred, on the other hand, is having a bit too much fun. There’s no way he’d be seen in an old car, so he bought himself a new Acura ILX. The monthly payment is about what it would cost him to fund his Roth IRA. He has the rest of his life to save, and he believes he shouldn’t be wasting his twenties worrying about retirement. However, Fun Fred wakes up at the age of 35 and decides he better start saving for this retirement thing. It is creeping up on him faster than he expected. Fun Fed contributes $5,000 per year until he’s 65. Fun Fred contributes a total of $150,000 over 30 years, which is double the money and double the number of years contributed by Saver Steve.

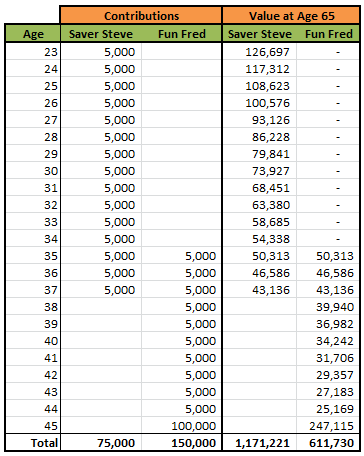

As you can see in the contributions table, Saver Steve contributes a total of $75,000 for 15 years. Fun Fred, on the other hand, contributes $150,000 over 30 years. Below is a table that shows how much each individual contribution is worth at the age of 65 after earning an average of 8% per year.

As you can see, Saver Steve contributed half the amount of Fun Fred, and contributed for half the number of years, yet he ended up with nearly double as much money as Fun Fred at the age of 65. Because Saver Steve started his investing early, he ended up with $559,000 more than Fun Fred. The first $5,000 that Saver Steve invested later became worth $126,000. That same $5,000 invested at age 35 only became worth $50,000.

By starting early in a Roth IRA, you are able to invest your after-tax dollars and withdraw them later without having to pay any taxes. That means you will never pay any taxes on capital gains or dividends once you invest the money in a Roth IRA. I’ll make a post soon detailing the benefits of the Roth IRA and some of the more interesting things you can do with it. But bottom line: If you’re young, you should be contributing to a Roth IRA and investing that money in some good, low-cost index funds.

Don’t sweat the slight dip in value that you’ve recently seen. As you know you’re investing in your future and you will be a millionaire one day. Great, great job! I wish my 20-something kids were as smart as you. I’m working on them though 🙂

I’m old enough now to occasionally grumble about “young people these days.” I see them driving around with expensive wheels on their cars and shopping for costly big-screen TVs. I think about how much money they’d have for retirement if they’d just save and invest that money, instead of spending it.