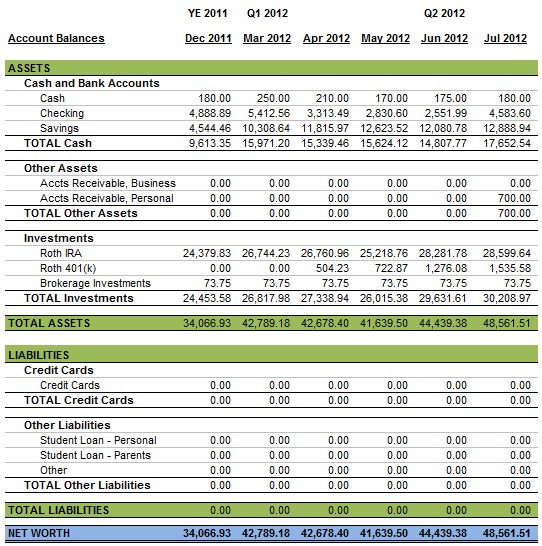

The positive results during June have rolled into July as I saw a nice uptick in my net worth.

You can also check out my balance sheet for each quarter since I started tracking.

YTD, my net worth is up over $14k, which is good enough for me at this point, especially when you consider what I’ve done over the last year. In September 2011 I left my first job out of college after working there for 1 year and 1 day. When doing this, I took a pay cut. Yup. I disliked my previous job so much that I took a different job that paid me less money. Ideally, when you switch jobs you should be making more money. But that’s not how it always works out.

My investments also haven’t contributed significantly to this net worth change. My amount added from investment gains (not contributions) is about $2k. That means the rest of the $12k came from me saving money. This is very good, because I have some big expenses that I’m saving for (wedding and car).

I am making big strives toward my goals. I’m not sure when I’ll buy a car, and whether it will be new or used, but I have added $4,100 to my car savings account, which means I have $5k saved for a car. That makes me feel confident that if anything were to happen to my current car tomorrow it wouldn’t be an emergency to go and replace it. I have enough to get me a 2005 compact sedan if I buy used, or I can use the money to put down on a new vehicle. I’ve also saved a total of $6,200 for my wedding and honeymoon next summer. Total cost of the wedding will likely be about $20k, with parents on both sides helping with some of the costs. I am ahead of schedule for both of these goals, although the Wedding & Honeymoon goal isn’t very far ahead, and my Roth IRA goal is behind where it should be at this point. Although, I’m fine with being behind on that one for now since I contributed $1.5k to the Roth 401(k) that I did not factor into my original 2012 personal finance goals.

On the balance sheet I’ve also added a receivable for $700. I am a season ticket holder of an NHL team and I sell about 3/4 of the season to other people. So far I have a contract to sell 1/2 of the season. I’ve paid out about half of the money for the whole season, yet I won’t collect from the buyer into later, so I’ve added a receivable for the pro-rated amount of what I’ve paid that I expect to receive from him. This will ensure that the hockey tickets don’t have a greater affect on my balance sheet than they truly will.

Although I don’t make a habit of it, I also put together a quick income statement for the month. I calculated all of my income and then all of my expenses to come up with “net income”, although typically a “net income” isn’t calculated for individuals. This ends up being the money I have available for saving or investing.

My income from sources other than my day job isn’t usually almost $3k per month, but I didn’t get much last month so it stacked up. I treat my finances on a cash-basis unless for some reason I think it truly distorts the reality of my balance sheet. So if I felt that I would have a large tax liability net April, I would accrue a liability for this even though I wouldn’t pay the cash until April. But overall, keeping things on the cash basis keeps it simple and “more real”. Hopefully next month brings more great things and I can finish off my car savings goal and then focus on the wedding goal and maybe start saving for a house this year.

Good Job & Keep up the good work. It looks like you’re making good progress towards all your goals. I’m looking forward to following along!

Thanks for checking in! I’ve been pretty fortunate while working on my goals and haven’t faced any major obstacles that have set me back so I have been able to just keep chugging along.