Real Estate obviously impacts so many people. For most people, their home is their largest asset (assuming they aren’t under water). In recent years, the home even became the “retirement fund” for some. As you know, that bubble burst. If you generally don’t follow up with the different housing metrics you may be assuming we’ve pretty much bottomed out. That seems to have been the consensus over the last half of a year or so. However, it doesn’t seem like the price of housing is done falling for now. In May the tax credits for purchasing a home expired, and guess what? Housing prices have been declining since.

To give you some background on what I’m looking at, first let me introduce you to Robert Shiller. Shiller is a professor at Yale who wrote the book Irrational Exuberance. In Irrational Exuberance, which was published in March 2000, Shiller made the argument that the U.S. stock market was in an extreme speculative bubble. We know how this one ended…It was the largest stock bubble in a while. Stay-at-home moms had become day traders. You may think back and say: “Hey Will, it’s obvious that the market was in a bubble. All he did was write a book about it.” If that’s the case, someone didn’t warn this Amazon reviewer about the bubble: “He [Shiller] reminds me of most old school economists who have no understanding of the current market and can only rationalize it as a bubble.” Agreed. If only these academics would stop messing around with the markets. We all know that the world has changed and the old rules of the market don’t apply. Things like P/E ratios and PEG ratios. Who needs those? Why would a company need to be profitable? Nothing is wrong with unprofitable companies having billion dollar valuations. Haha.

Okay, but back to Shiller. So he published the first Irrational Exuberance book in 2000. Guess what he published in 2005? The second edition of Irrational Exuberance. In this Second Edition he argued that the housing market was experiencing a bubble. Shiller warned that “significant further rises in these markets could lead, eventually, to even more significant declines. The bad outcome could be that eventual declines would result in a substantial increase in the rate of personal bankruptcies, which could lead to a secondary string of bankruptcies of financial institutions as well. Another long-run consequence could be a decline in consumer and business confidence, and another, possibly worldwide, recession.” Seriously…Could you be more correct? The timeliness of both of his books still boggles my mind. The bursting of the bubble occurred in 2006.

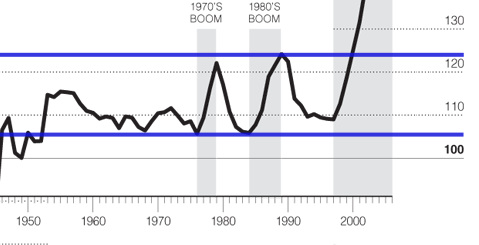

So, now you’re probably wondering why I introduced Shiller. Well, he created an index of housing prices dating back to 1890. The index is now maintained by S&P, but he’s still involved. I think the best way to explain this is going to be to start with the graph. (You can click for a larger image)

The Case-Shiller index measures the value of single-family homes over time. Check out the description on the image above for an explanation of how the measurements shown are used. Basically, what the Case-Shiller index tells us, is that over time, housing prices haven’t changed much when adjusted for inflation. I added the red part in basically to show you what housing prices have done since their peak. The red-line is not accurate cause I just drew it by hand on top of this image from Irrational Exuberance/NYTimes. It still gives you a rough idea though. As you can see in this image below, it appears that between the end of World War II and 2000, there was a period of normalization in the range I’ve marked in blue. It looks like prices began to hang out around 110 (instead of 100).

To deal with this apparent shift, the Case-Shiller index was adjusted to peg 100 as the 2000 rate. (Note: on the first graph above, this would be about ~115). Okay, it might be getting confusing at this point, so just check out this graph from the recent press release:

If housing prices are to revert to their mean over the last 50 years, they still need to drop approximately 33%. I’d say that if you were to ask the average person whether they think housing prices will continue to go down, they would say no. That means either: 1. Housing prices aren’t going to revert back to the 100 level, or 2. There’s a disconnect between what people want to think their homes are worth, and what they are actually worth. I’m not a betting man, but I think I’d place my money on the second option. I’m not one to buy into the whole “new economy” explanation (as is used to justify just about any bubble pricing). I also think that people are too attached to the price levels they saw in the past to give in and realize the true value of their homes. Nobody wants to “lose” all that money in equity that they had in their home. If housing prices are indeed going to return to their historical level, the prices can either remain stagnant for years while inflation catches up, or they can fall. I think we might see a bit of both. Maybe 20% falling, and then stagnant prices. I really don’t study the subject though, so there are many others who can make more educated assessments.

Either way, as someone who is looking to buy a house in the future, I’m excited at these prospects. For those of you who already own a home, this should not affect you unless you’re planning on selling your home anytime soon. If you plan on living in your home for the next 10 or 15 years, these short-term gyrations shouldn’t affect you. Whichever way the market goes, there’s not much we can do about the pricing. And like the stock market, it’s difficult to time the market. You can tell when things are on discount, or when the prices are inflated overall, but it’s difficult to predict the short-term future of prices and truly time the market. Wealth in real estate depends largely on entry price, and the only way to guarantee a price is to buy now.

What do you think? Are you buying a home soon? Does this information make you want to hold off and wait? Let me know by commenting below.

What is really scary is the amount of foreclosures banks still have on their books that they have not released to be sold. Even more supply for already weak demand. Might not be good. Bank of America my have a lot of exposure.

Well, I’m already a home owner. I bought at the end of 2008 when a lot of this stuff was already going on. I knew what I was getting into and I knew I wouldn’t make any sort of profit on this house but bought anyway, I also knew I probably wouldn’t live here long-term and I took that all into account. Thankfully my house was dirtcheap and the mortgage at a great rate so I’ll come out all right I think. I am excited though at the opportunities I suspect will arise when I’m ready to move to another house because I don’t think we’ve seen the bottom yet.

Your comment made me think about it a little more and it makes sense. Even if you’re buying now and intend to only live there a few years, you can still end up find assuming you bought at a great price and you aren’t upside down. If the housing market falls more, and you don’t have to sell quickly, you can wait for the price you want, while getting a great deal from someone else when buying your next home (assuming they’re a distressed, motivated seller). So many factors at play, you can definitely still come out ahead.